Why Multifamily investing

Why Multifamily

What is Multifamily Real Estate

Multifamily properties provide housing for multiple families or individuals, such as apartment rental properties and condos. Breneman Capital focuses on acquiring for rent multifamily properties.

Historical Performance

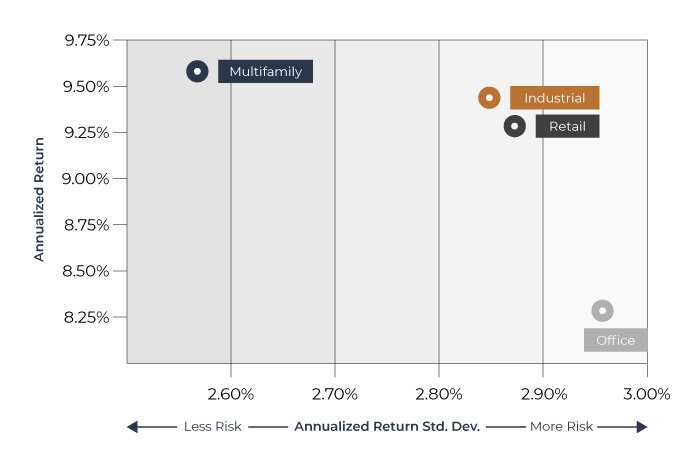

In a Breneman Capital study of historical real estate investment returns per NCREIF, Multifamily outperformed all major commercial property types between 1990-2020. We measured all possible return scenarios for 3, 5, 7, and 10 year holding periods, and Multifamily overwhelmingly provided investors the highest average return and the least volatility when compared to the Industrial, Office, and Retail sectors.

Multifamily had the highest average investment return of all hold period scenarios. It also had the lowest return standard deviation in all scenarios except for the 10 year. Investors should have confidence that their commitment to Breneman Capital will be in the form of an exceptional risk-adjusted investment.

Echo Tempe - 24 Units

Population and Consumer Trend Tailwinds

Current Renters Renting Longer

Our culture and country are changing. Homeownership is declining and people are waiting longer to get married and become parents, which expands the time in their lives where they typically rent, leading to a greater need for multifamily rental properties.

Significant Portions of the Population Entering The Rental Market

Young: Gen Z, born between 1998 and 2012, make up approximately 25% of the U.S population and are entering the rental market.

Old: 10,000 individuals turn 65 years old every day. At this age, many seniors tend to look to downsize from their homes and move to rental communities that offer flexibility and require less hands-on maintenance.

Multifamily Holds Up Better Over the Long Term in Remaining Functionally Relevant

“Everyone has to live somewhere” is the common saying, but the multifamily sector’s proven resilience to functional obsolescence should not be relegated to just an expression – we have data to back it up. In a Breneman Capital study of over 300,000 properties, we measured vacancy rates for older generations of properties (built before 1991) against newer generations (built 1991-2010). For the period between 2014 and 2021, multifamily demonstrated the best fundamentals and performed 3x better than Industrial, 6.5x better than Office, and 8x better than Retail.

Change in tenant preferences will always be a constant force in real estate, and advancements in the way we live, shop, and conduct business will manifest as new supply enters the market. What is apparent, however, is that this phenomenon affects the four major real estate sectors disproportionately.

Other Factors Benefiting Multifamily

-

Our track record for success

-

Why Choose Breneman Capital

Breneman Capital focuses on providing our investors with the best risk-adjusted investment opportunities in carefully selected markets across the U.S., researched and underwritten with extreme detail from our headquarters in Chicago.