How much of your portfolio should be in real estate?

There are many factors to take into account when deciding what percentage of an investment portfolio should be invested in real estate.

What’s more, the answer is likely to be different depending on whether the addressee is an individual or institutional-type entity. In fact, even the type of investment entity being questioned can make a difference to the answer. For example, a REIT Manager may have different constraints or limits on the amount to invest in real estate which, say, a private equity fund manager may not have.

Allocation influencing factors

In any event, the ultimate decision for an individual on how much to invest in real estate will depend on factors such as:

the amount of capital available to invest;

what percentage of the person’s net worth this represents;

the investment objectives, i.e. to produce a retirement income stream or seek long term capital appreciation;

the need for liquidity;

risk tolerance;

age of investor (proximity to retirement age);

investment time horizon

Another important influencing factor can be said to be opinions offered by leading universities or academic institutions. Overall, the consensus of such research is that investors get a better risk/return profile from owning real estate, although suggested allocation percentages still tend to vary between researchers.

For example, research from the University of Florida states that model portfolios which have a mixture of stocks, bonds and real estate outperform other portfolios. In view of this, the “optimal mix” should be 50% real estate, 30% stocks and 20% bonds. Allocating investment funds as per this formula should be sufficiently diversified to provide stability in retirement, with the real-estate component including personal dwellings and investment property.

Trends in institutional investing

It is interesting to examine in more detail fund allocation trends of institutional investors. Even here it is accepted that there is no single “right” formula to determine investors’ optimal exposure to real estate—there are simply too many variables.

However, it is noteworthy that between 2001 and 2020, institutional investors’ aggregate investment allocation in real estate has steadily increased—actually doubling from 4.4% to 8.8% over these 20 years. The gradual but significant redirection of funds from equities and fixed income into real estate has been taking place annually over this timeframe.

An excellent example of this is the way one of the largest state employee pension funds in the word, the State of California Public Employees Retirement System (“CalPERS”), has steadily increased its allocation of funds to real estate over the last 15 years. Figures show an increase from 7%, almost doubling to 13% between 2006-2020.

The overall expectation for institutional investors is that:

there will be a continued strong investment by defined benefit plans into real estate, probably meaning higher percentage allocation of funds;

new investment vehicles will be created for defined contribution plans;

there will be limited cap rate expansion in the event of any downturn;

demand will increase for larger real estate assets or asset “platforms”.

High net worth investors

Apart from institutional investors, high net worth (“HNW”) individual investors are an important demand driver for real estate investment. Being more flexible and self-determining, many HNW investors have the ability to invest alongside sponsors or co-investors. They can focus on properties which may be too small for institutional investors or where the institution is not nimble enough to quickly conclude a transaction.

HNW can, therefore, identify mismanaged or mispriced real estate and capitalize on market inefficiencies, which meet their expectations of returns well above those sought by institutional managers (~7.5%).

A recent survey by Tiger 21, a membership organization of HNW entrepreneurs, investors, and executives found that real estate investment was the top allocation amongst its members, with an average of 27% of a portfolio.

Another important insight from this survey was that, as wealth increases, investors allocate more to non-liquid alternatives. This averaged 53% of a HW investor’s portfolio in private equity and real estate, suggesting that the need for liquidity becomes less important as a person’s wealth increases.

Finally, a strategy being frequently observed of late is for HNW individuals rotating funds out of bonds and into real estate. If the funds in bonds were not needed, this is a particularly appealing move given real estate’s higher potential total return and cash flow to replace the bond yield.

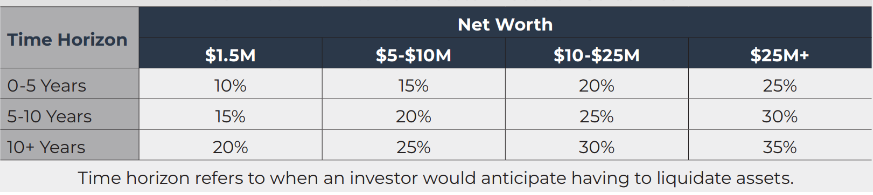

Taking into account the aforementioned trends and other key factors, below is the Breneman Capital recommended allocation based on net worth and need for liquidity.

Breneman Capital

Breneman Capital is a data-driven multifamily investment firm pushing the real estate industry into the future with a modern approach to direct real estate investments.

We focus on providing our investors with the best risk-adjusted investment opportunities in carefully selected markets across the U.S., researched and underwritten with extreme detail from our headquarters in Chicago.

The best part, Breneman Capital is your one-stop-shop for all your direct real estate investment needs.

To begin receiving high-quality investment opportunities from us, sign up today: