Our Strategy

Our Strategy

Off-Market Deal Flow

Through an insatiable drive to form new strategic relationships and cultivate existing ones, we identify mispriced opportunities off-market and limit competition.

Decisive Approach

Our firm conducts exhaustive market selection analyses, with individual investments then being tailored to maximize returns and minimize downside risk through Core Plus and Value-Add strategies.

Leveraging Technology

We develop and maintain institutional quality underwriting, market research, and advanced analytical models that guide our investment process. We obsess over finding signal within the noise.

Off-market deal flow is our Advantage

Over 80% of our acquisitions have been either off-market, from a repeat broker, or from a repeat seller.

Ashland Place in West Loop, Chicago, IL - 47 Units

Decisive Approach

Multifamily

Market Selection

$5M - $50M

After 1980

We maintain deliberate methods, ruthlessly pursue knowledge, and build our reputation. We do not divert attention from our course, because precision matters. That is why Breneman Capital specializes in multifamily. Our goal is to become market experts. As such, we optimize investment performance by leveraging predictive technology for market selection and study locations within our target markets with increasing granularity. Moreover, we focus specifically on properties priced between $5M-$50M to limit the competitive landscape of individual investors and large institutional investors, and we minimize risk by investing only in properties built or renovated after 1980.

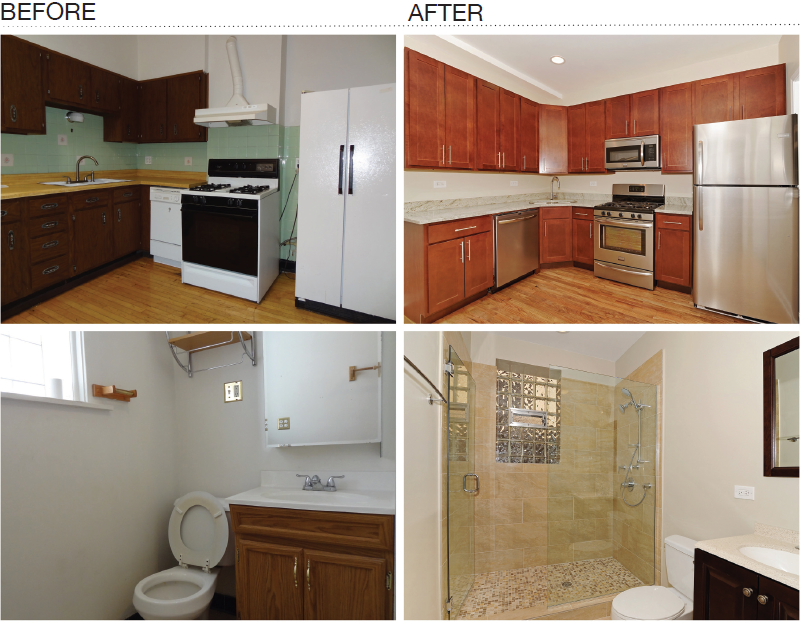

Core Plus

Newer vintage properties exhibiting outsized return potential relative to execution risk and involving little to no capital improvement.

Value-Add

Forced appreciation through capital and operational improvement.

INDUSTRY-LEADING UNDERWRITING MODEL

Advanced automation, data aggregation, visualization, and financial features.

Dynamic underwriting capabilities.

COMPREHENSIVE INVESTMENT DATABASE

Tracks 900+ variables for every underwritten opportunity.

Connected seamlessly to our underwriting model through Visual Basic code.

Efficient pipeline management and custom analyses.

RENT REGRESSION MODEL

Compatible with Yardi rent comparable reports.

Identify property rent comparables quickly through automated sorting and regression modeling.

MARKET OUTLOOK DATABASE AND MODEL

Predictive model for long-term appreciation performance in the largest markets across the US.

Measures key market indicators including Economic, Demographic, Apartment Fundamentals, Affordability, and New Supply trends.

Integral component to market selection process in targeting areas of the country most poised for outperformance.

ZIP CODE SCORING MODEL

Zip code-specific scoring system comprised of 46 variables spanning demographic, economic, housing, and growth statistics.

Designed to quantify the desirability of locations and to identify the most optimal submarkets for investment.

Aggregates for over 12,000 zip codes spanning 52 of the largest MSA's in the country.

Leveraging Technology

-

Investor Experience

-

Why Invest in multi-family

Breneman Capital focuses on providing our investors with the best risk-adjusted investment opportunities in carefully selected markets across the U.S., researched and underwritten with extreme detail from our headquarters in Chicago.