Navigating Real Estate Investments with Precision: Our Location Scoring Methodology

You’ve likely heard the old adage before – the three most important rules of real estate are: “location, location, location.”

Location is something we obsess over daily.

It might be the most crucial reason certain investments overperform or underperform, and it can be the deciding factor for why we, as real estate investment professionals, choose to proceed with or pass on a potential investment.

That’s why Breneman Capital adopted a comprehensive location scoring methodology to guide our investment process.

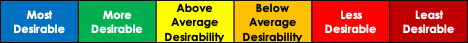

We aggregated data from over 12,000 zip codes across 52 of the largest markets in the country. The data spans demographic, economic, housing fundamentals, and growth indicators to quantify the desirability and investment viability of specific locations at the zip code level.

This unique tool was developed internally, giving Breneman Capital and our investors a competitive edge for identifying investments poised for outsized performance.

Our location scoring methodology is one of the many ways that Breneman Capital continues to innovate in the multifamily space by leveraging advanced analytics for our investment thesis.

When comparing other multifamily sponsors, our investors can be assured that Breneman is at the forefront of using sophisticated locational technology for investment selection.